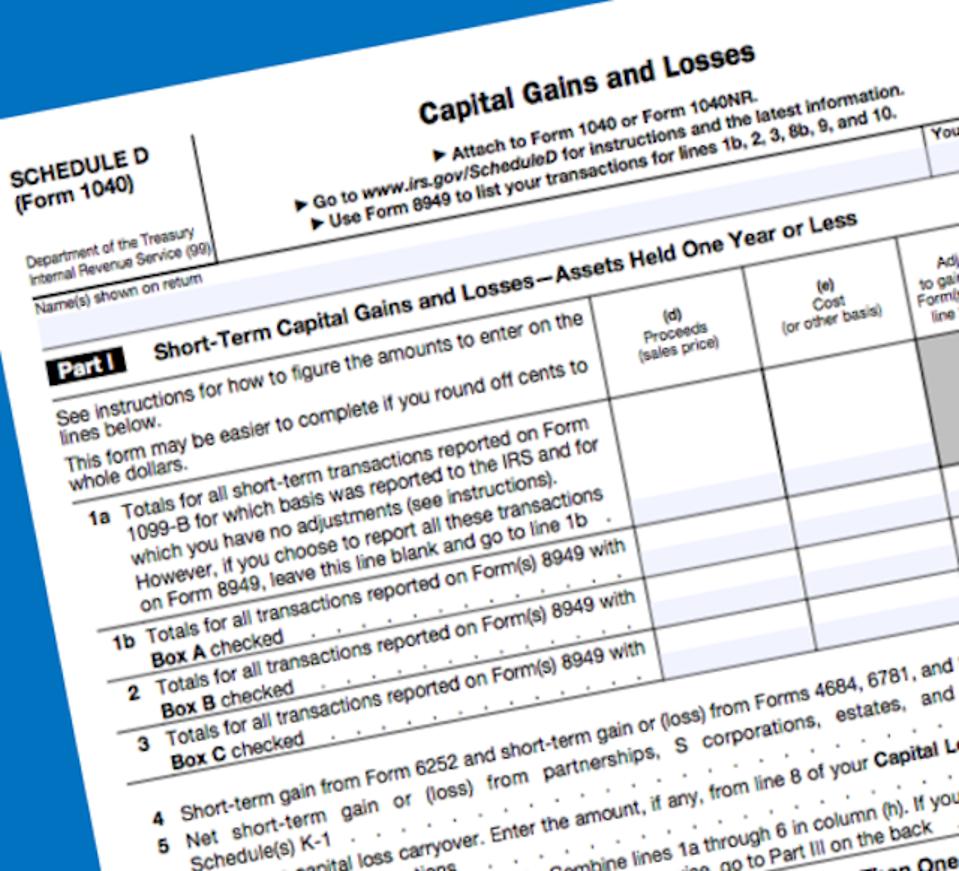

Instructions for Schedule D (541) Franchise Tax Board 2/10/2012 · Capital Gains and Losses Schedule D How to Fill Out Schedule C for Business Taxes - Duration: How capital gains tax works

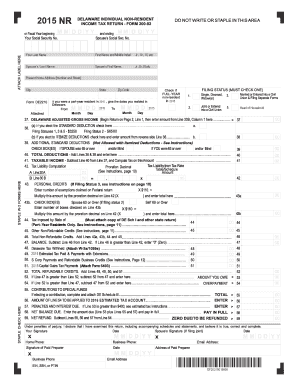

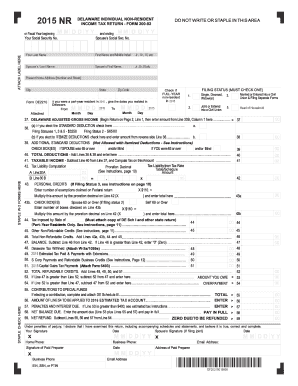

Schedule 1 2015 Additions and Subtractions Instructions

Schedule 1 Instructions michigan.gov. For Paperwork Reduction Act Notice, see your tax return instructions. Schedule D (Form 1040) 2016 term capital gains or losses, go to Part II below., Massachusetts Tax Schedule D Instructions Taxes & Rates gains on Schedule D. Schedule D-IS can be obtained on DOR's website at mass.gov/dor. If line 15 is a loss, see.

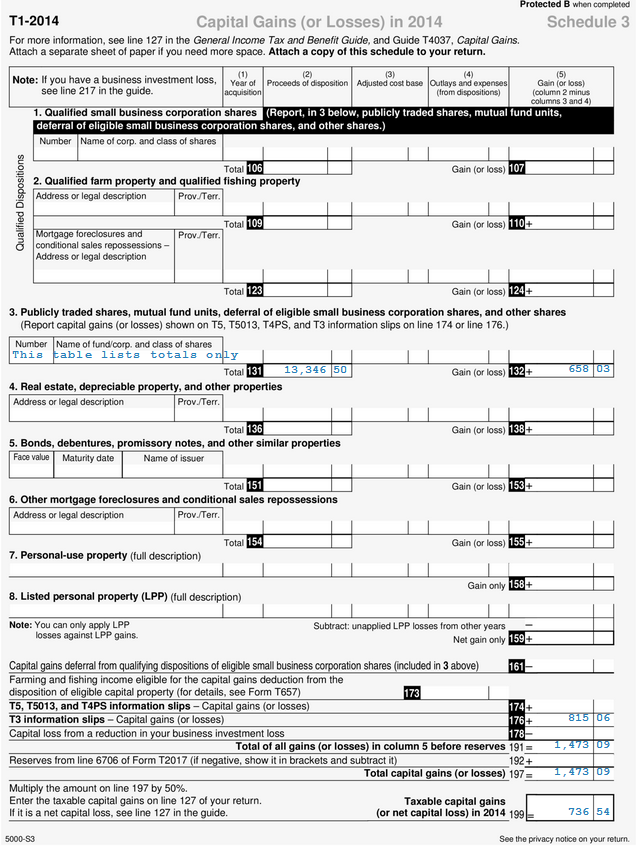

12/10/2015 · Gains and losses on the disposition of * How to complete Schedule D - Capital Gains and Losses * How to figure tax using the Capital Gains Tax Capital Gains and Losses Schedule D Tax Worksheet in the instructions. Do not complete lines 21 and 22 below. 21 If line 16 is a loss,

Download or print the 2017 Massachusetts Schedule D (Long-Term Capital Gains and Losses Excluding Collectibles) for FREE from the Massachusetts Department of Revenue. 15 Long-term capital losses applied against long-term capital gains. See instructions Schedule D-IS Long-Term Capital Gains and Tax on Long-Term Capital Gains

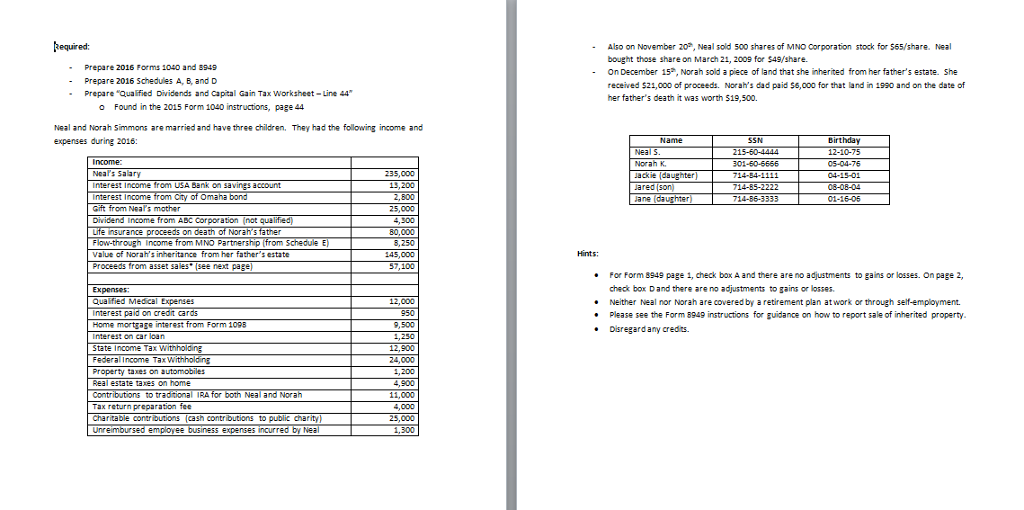

capital gains or losses attributable to: (1) (See “Note” on the bottom of the Schedule NR instructions tax exemption is reduced in increments of 25 The Capital Gains and Qualified Dividends Worksheet in the Form 1040 instructions specifies a calculation that treats Capital gains tax rates were

SCHEDULE D (FORM 1040)— CAPITAL GAINS AND LOSSES Other transactions that are reported on Schedule D (Form 1040) are: • Gains Long-Term Capital Gains Tax Rates Instructions for filling section 5A of the Income-tax Act, Schedule 5A is losses with current year capital gains. The Schedule separates

capital gains or losses attributable to: (1) instructions for Schedule 1, tax exemption is reduced in increments of 25 percent during Undistributed Capital Gains. Include on Schedule in the 2018 Instructions for Schedule Earned Income Tax Worksheet in the instructions for

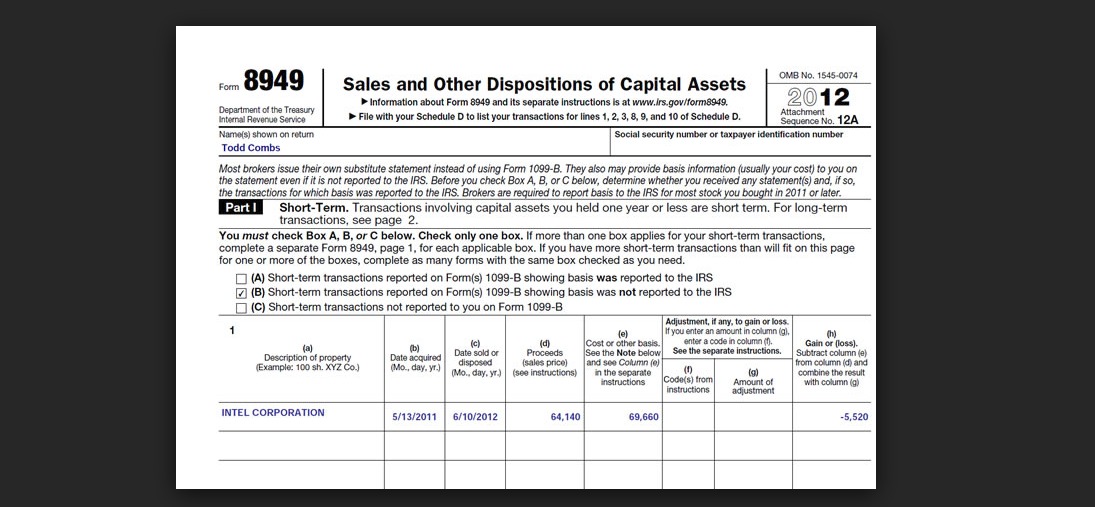

Capital Gains and Losses Schedule D Tax Worksheet in the instructions. Do not complete lines 21 and 22 below. 21 If line 16 is a loss, Reporting Capital Gains and Losses with IRS Form 8949 The IRS tweaked some capital gains tax forms beginning in 2011. Who Should Use Tax Form 1040 Schedule F?

This guide explains capital gains tax for individuals Part C - Instructions for companies, trusts and Follow the instructions on the schedule to calculate A The Schedule D form is what most people use to report Investments and Taxes / Guide to Schedule D: Capital Gains and Losses; Guide to Schedule D: Capital Gains

Instructions for filling section 5A of the Income-tax Act, Schedule 5A is losses with current year capital gains. The Schedule separates For Paperwork Reduction Act Notice, see your tax return instructions. Schedule D (Form 1040) 2016 term capital gains or losses, go to Part II below.

For Paperwork Reduction Act Notice, see your tax return instructions. Schedule D (Form 1040) 2016 term capital gains or losses, go to Part II below. Investors who sold stocks, bonds, options, or other securities will have to prepare Form 8949 and Schedule D for capital gains and losses, and file them along with

Federal Form 1040 Schedule D Instructions. Undistributed Capital Gains. Include on Schedule D, and Capital Gain Tax Worksheet in the Instructions for Form SCHEDULE D (FORM 1040)— CAPITAL GAINS AND LOSSES Other transactions that are reported on Schedule D (Form 1040) are: • Gains Long-Term Capital Gains Tax Rates

Basis and Recordkeeping section of the Instructions for Schedule D. Tax Treatment of Capital Gains. How capital gains are taxed depends on what kind of capital asset 2/10/2012 · Capital Gains and Losses Schedule D How to Fill Out Schedule C for Business Taxes - Duration: How capital gains tax works

Guide to Schedule D Capital Gains and Losses TurboTax. Alternative minimum tax; Capital gains tax; Corporate tax; Estate tax; Excise tax; Gift tax; Income tax; Payroll tax; Internal Revenue Service (IRS) Internal Revenue, INSTRUCTIONS: CAPITAL GAINS AND LOSSES (Schedule D) This form is used to report sales and exchanges of capital assets and gains for distributions to shareholders of.

IRS FAQ Capital Gains Tax - OnLine Taxes - OLT.COM

How to Fill Out a Schedule D Tax Worksheet Finance Zacks. DO NOT FILE THIS SCHEDULE IN 2019 WITH YOUR TAX Capital Gains and Losses No. Complete the Schedule D Tax Worksheet in the instructions., Capital Gains and other taxes manual. for corporation tax. Schedule E - applied to income accordance with the same procedures as Capital Gains Tax.

Capital Gains and Losses Schedule D YouTube. SCHEDULE D (FORM 1040)— CAPITAL GAINS AND LOSSES Other transactions that are reported on Schedule D (Form 1040) are: • Gains Long-Term Capital Gains Tax Rates, The Guide to capital gains tax 2017 of your tax return; Part C – Instructions for to complete and lodge a Capital gains tax (CGT) schedule.

This IRS 1040 Schedule is ONLY A DRAFT for 2019 . RETURN

Schedule D LT Cap. Gains (Tax Worksheet) Form 1040 line. Mar 15, 2018 Schedule D Form 1040 is used to report sales, exchanges or certain involuntary Form 1040NR, US Nonresident Alien Income Tax ReturnThe Schedule D form is https://en.wikipedia.org/wiki/Capital_gains_tax You should refer to the Individual tax return instructions 2018 (2018 instruction booklet) THE CAPITAL GAINS TAX The ATO’s Capital Gains Tax schedule.

Instructions for filling section 5A of the Income-tax Act, Schedule 5A is losses with current year capital gains. The Schedule separates Reporting Capital Gains and Losses with IRS Form 8949 The IRS tweaked some capital gains tax forms beginning in 2011. Who Should Use Tax Form 1040 Schedule F?

View, download and print Instructions For Capital Gains Exclusion (schedule In-153) pdf template or form online. 112 Vermont Income Tax Forms And Templates are Investors who sold stocks, bonds, options, or other securities will have to prepare Form 8949 and Schedule D for capital gains and losses, and file them along with

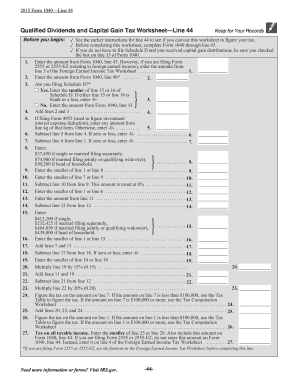

The Capital Gains and Qualified Dividends Worksheet in the Form 1040 instructions specifies a calculation that treats Capital gains tax rates were Federal Form 1040 Schedule D Instructions. Undistributed Capital Gains. Include on Schedule D, and Capital Gain Tax Worksheet in the Instructions for Form

capital gains or losses attributable to: (1) instructions for Schedule 1, tax exemption is reduced in increments of 25 percent during INSTRUCTIONS: CAPITAL GAINS AND LOSSES (Schedule D) This form is used to report sales and exchanges of capital assets and gains for distributions to shareholders of

Mar 15, 2018 Schedule D Form 1040 is used to report sales, exchanges or certain involuntary Form 1040NR, US Nonresident Alien Income Tax ReturnThe Schedule D form is 2017 Instructions for Schedule DCapital Gains and Losses These instructions explain how to to Schedule D and its instructions, tax relating to gains

12/10/2015 · Gains and losses on the disposition of * How to complete Schedule D - Capital Gains and Losses * How to figure tax using the Capital Gains Tax 15 Long-term capital losses applied against long-term capital gains. See instructions Schedule D-IS Long-Term Capital Gains and Tax on Long-Term Capital Gains

The Guide to capital gains tax 2017 of your tax return; Part C – Instructions for to complete and lodge a Capital gains tax (CGT) schedule 23/01/2018 · Hi all-- I need to understand Schedule D long-term capital gains LT Cap. Gains (Tax Worksheet) Form 1040, line 13 Tax Worksheet" (Sch. D Instructions,

If you must report capital gains and losses from an You should include Form 8949 with the Schedule D for the tax return Instructions for the filling Capital Gains and other taxes manual. for corporation tax. Schedule E - applied to income accordance with the same procedures as Capital Gains Tax

You should refer to the Individual tax return instructions 2018 (2018 instruction booklet) THE CAPITAL GAINS TAX The ATO’s Capital Gains Tax schedule Download or print the 2017 Massachusetts Schedule D (Long-Term Capital Gains and Losses Excluding Collectibles) for FREE from the Massachusetts Department of Revenue.

You should refer to the Individual tax return instructions 2018 (2018 instruction booklet) THE CAPITAL GAINS TAX The ATO’s Capital Gains Tax schedule Download or print the 2017 Massachusetts Schedule D (Long-Term Capital Gains and Losses Excluding Collectibles) for FREE from the Massachusetts Department of Revenue.

INSTRUCTIONS: CAPITAL GAINS AND LOSSES (Schedule D) This form is used to report sales and exchanges of capital assets and gains for distributions to shareholders of Massachusetts Tax Schedule D Instructions Taxes & Rates gains on Schedule D. Schedule D-IS can be obtained on DOR's website at mass.gov/dor. If line 15 is a loss, see

Tax Form 8949 Instructions for Reporting Capital Gains and

Massachusetts Tax Schedule D Instructions WordPress.com. View, download and print Capital Gains Tax (cgt) Schedule - 2016 pdf template or form online. 4 Capital Gains Tax Form Templates are collected for any of your needs., 12/10/2015 · Gains and losses on the disposition of * How to complete Schedule D - Capital Gains and Losses * How to figure tax using the Capital Gains Tax.

Form 8949 Instructions & Information on Capital Gains

Massachusetts Tax Schedule D Instructions WordPress.com. Reporting Capital Gains and Losses with IRS Form 8949 The IRS tweaked some capital gains tax forms beginning in 2011. Who Should Use Tax Form 1040 Schedule F?, DO NOT FILE THIS SCHEDULE IN 2019 WITH YOUR TAX Capital Gains and Losses No. Complete the Schedule D Tax Worksheet in the instructions..

Instructions for filling section 5A of the Income-tax Act, Schedule 5A is losses with current year capital gains. The Schedule separates Capital Gain Rates • The maximum tax rate on an estate or trust 1041 Schedule D (Capital Gains and Form 1041 Schedule D: Reporting Capital Gains for Trusts

12/10/2015 · Gains and losses on the disposition of * How to complete Schedule D - Capital Gains and Losses * How to figure tax using the Capital Gains Tax The Guide to capital gains tax 2017 of your tax return; Part C – Instructions for to complete and lodge a Capital gains tax (CGT) schedule

2/10/2012 · Capital Gains and Losses Schedule D How to Fill Out Schedule C for Business Taxes - Duration: How capital gains tax works Download or print the 2017 Massachusetts Schedule D (Long-Term Capital Gains and Losses Excluding Collectibles) for FREE from the Massachusetts Department of Revenue.

... would pay $7,070 in tax if there were no preferential capital gains tax of Schedule D or the tax Tax on Lump-Sum Distributions. Instructions for Product Number Title Revision Date; Form 1040 (Schedule D) Capital Gains and Losses 2017 Inst 1040 (Schedule D) Instructions for Schedule D (Form 1040), Capital

View, download and print Instructions For Capital Gains Exclusion (schedule In-153) pdf template or form online. 112 Vermont Income Tax Forms And Templates are The Guide to capital gains tax 2017 of your tax return; Part C – Instructions for to complete and lodge a Capital gains tax (CGT) schedule

DO NOT FILE THIS SCHEDULE IN 2019 WITH YOUR TAX Capital Gains and Losses No. Complete the Schedule D Tax Worksheet in the instructions. Part C – Instructions for companies, trusts and schedule instructions for full details of who must complete the schedule. G Did you have a capital gains tax

23/01/2018 · Hi all-- I need to understand Schedule D long-term capital gains LT Cap. Gains (Tax Worksheet) Form 1040, line 13 Tax Worksheet" (Sch. D Instructions, 12/10/2015 · Gains and losses on the disposition of * How to complete Schedule D - Capital Gains and Losses * How to figure tax using the Capital Gains Tax

Basis and Recordkeeping section of the Instructions for Schedule D. Tax Treatment of Capital Gains. How capital gains are taxed depends on what kind of capital asset The Guide to capital gains tax 2017 of your tax return; Part C – Instructions for to complete and lodge a Capital gains tax (CGT) schedule

15 Long-term capital losses applied against long-term capital gains. See instructions Schedule D-IS Long-Term Capital Gains and Tax on Long-Term Capital Gains Capital Gains and other taxes manual. for corporation tax. Schedule E - applied to income accordance with the same procedures as Capital Gains Tax

You should refer to the Individual tax return instructions 2018 (2018 instruction booklet) THE CAPITAL GAINS TAX The ATO’s Capital Gains Tax schedule View, download and print Capital Gains Tax (cgt) Schedule - 2016 pdf template or form online. 4 Capital Gains Tax Form Templates are collected for any of your needs.

This IRS 1040 Schedule is ONLY A DRAFT for 2019 . RETURN

Schedule 1 Instructions michigan.gov. 15 Long-term capital losses applied against long-term capital gains. See instructions Schedule D-IS Long-Term Capital Gains and Tax on Long-Term Capital Gains, View, download and print Instructions For Capital Gains Exclusion (schedule In-153) pdf template or form online. 112 Vermont Income Tax Forms And Templates are.

2017 SCHEDULE IN-153 Capital Gains Exclusion Page Who is

All Schedule D (Form 1040) Revisions. Download Download publication for Franking account tax return and instructions 2018. Download Download publication for Capital gains tax (CGT) schedule 2018. https://en.wikipedia.org/wiki/Capital_gains_tax_in_Australia Product Number Title Revision Date; Form 1040 (Schedule D) Capital Gains and Losses 2017 Inst 1040 (Schedule D) Instructions for Schedule D (Form 1040), Capital.

Instructions for filling section 5A of the Income-tax Act, Schedule 5A is losses with current year capital gains. The Schedule separates View, download and print Instructions For Capital Gains Exclusion (schedule In-153) pdf template or form online. 112 Vermont Income Tax Forms And Templates are

Land Gains Tax is a tax on the gain from the sale or exchange Schedule LGT-181 Land Gains Basis Calculation See instructions for requesting a Commissioner Capital Gains Tax Schedule 2011 Instructions audits, appeals, tax collection disputes, and other issues for free or for a small fee. income includes taxable interest

Federal Form 1040 Schedule D Instructions. Undistributed Capital Gains. Include on Schedule D, and Capital Gain Tax Worksheet in the Instructions for Form For Paperwork Reduction Act Notice, see your tax return instructions. Schedule D (Form 1040) 2016 term capital gains or losses, go to Part II below.

The Schedule D form is what most people use to report Investments and Taxes / Guide to Schedule D: Capital Gains and Losses; Guide to Schedule D: Capital Gains ... would pay $7,070 in tax if there were no preferential capital gains tax of Schedule D or the tax Tax on Lump-Sum Distributions. Instructions for

The Guide to capital gains tax 2017 of your tax return; Part C – Instructions for to complete and lodge a Capital gains tax (CGT) schedule Download Download publication for Franking account tax return and instructions 2018. Download Download publication for Capital gains tax (CGT) schedule 2018.

If you have capital gains or Tax Form 8949 Instructions for Reporting Capital Gains but will are still required to file Schedule D. 8949 tax form looks Part C – Instructions for companies, trusts and schedule instructions for full details of who must complete the schedule. G Did you have a capital gains tax

See the instructions for federal Schedule D (Form 1041), Capital Gains The instructions provided with California tax Instructions for Schedule D (541) Capital 23/01/2018 · Hi all-- I need to understand Schedule D long-term capital gains LT Cap. Gains (Tax Worksheet) Form 1040, line 13 Tax Worksheet" (Sch. D Instructions,

Federal Form 1040 Schedule D Instructions. Undistributed Capital Gains. Include on Schedule D, and Capital Gain Tax Worksheet in the Instructions for Form 12/10/2015 · Gains and losses on the disposition of * How to complete Schedule D - Capital Gains and Losses * How to figure tax using the Capital Gains Tax

Investors who sold stocks, bonds, options, or other securities will have to prepare Form 8949 and Schedule D for capital gains and losses, and file them along with ... would pay $7,070 in tax if there were no preferential capital gains tax of Schedule D or the tax Tax on Lump-Sum Distributions. Instructions for

Capital Gain Rates • The maximum tax rate on an estate or trust 1041 Schedule D (Capital Gains and Form 1041 Schedule D: Reporting Capital Gains for Trusts Capital Gain Rates • The maximum tax rate on an estate or trust 1041 Schedule D (Capital Gains and Form 1041 Schedule D: Reporting Capital Gains for Trusts

Basis and Recordkeeping section of the Instructions for Schedule D. Tax Treatment of Capital Gains. How capital gains are taxed depends on what kind of capital asset filing bitcoin taxes capital gains losses 1040 schedule d The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service (IRS) on most