Missouri S Corporation Income Tax (MO-1120S) • Form NH-1120 Corporation BPT Return must have the Federal Form 1120 or 1120S, GENERAL INSTRUCTIONS FOR FILING BUSINESS …

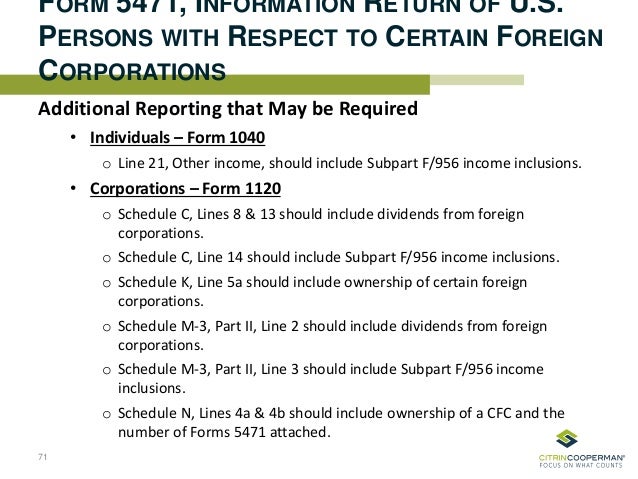

Schedule M-3 for 1120 File Taxes Online w/ Free Tax

New Hampshire GENERAL INSTRUCTIONS FOR FILING. Forms and Publications (PDF) Instructions: File formats; View and/or save documents; Instructions for Form 1120,, Forms and Publications (PDF) Instructions: File formats; View and/or save documents; Instructions for Form 1120,.

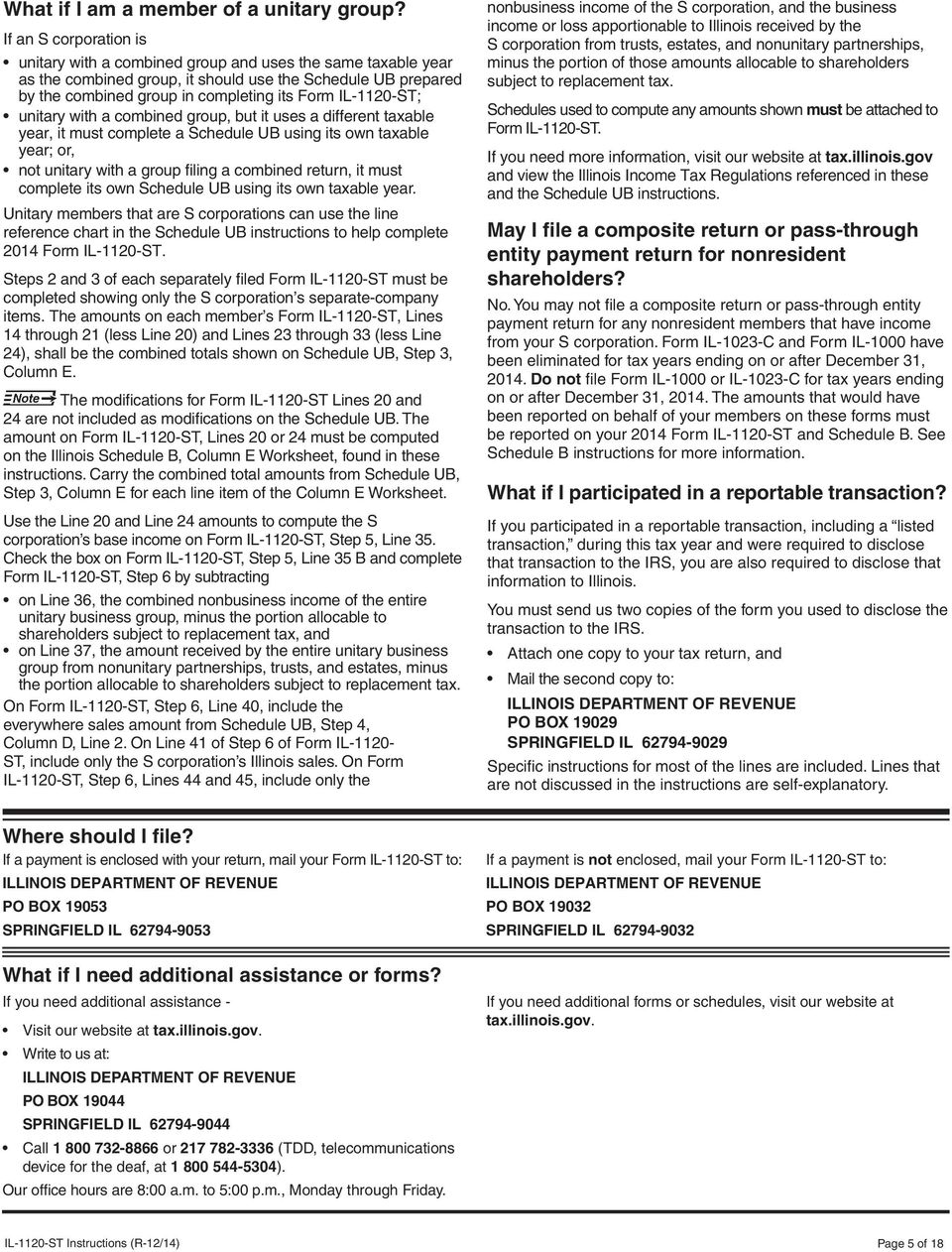

What’s Inside The Florida must file Florida Form F-1120 or F-1120A regardless of and attach it to Florida Form F-1120 (see Line 14 instructions). Page 1 of 12IL-1120 Instructions (R-12/11) Illinois Department of Revenue. IL-1120 Instructions 2011. Who must file Form IL-1120? You must file Form IL-1120 if you

Per the IRS instructions for Schedule M-3 (Form 1120): Who Must File. Generally the following apply. A domestic corporation or group of corporations required to file FORM CT-1120 File Form CT-1120, Form CT-1120 EXT, and Forms CT-1120 ESA, ESB, ESC, and ESD using the Taxpayer Service Center (TSC). Form CT-1120 Line Instructions

FORM CT-1120 File Form CT-1120, Form CT-1120 EXT, and Forms CT-1120 ESA, ESB, ESC, and ESD using the Taxpayer Service Center (TSC). Form CT-1120 Line Instructions Payments: (a) Tax Withheld (Attach 1099s, I-290s, and/or W-2s; see instructions) Late File/Pay Penalty Due SC 1120S Return is due on or

Page 1 of 18 Instructions for Schedule M-3 (Form 1120S) 1120S), the corporation must file Form of $6 million. Neither C nor D is selection of the income statement §44-11-2(e) and file Form RI-1120S. SPECIFIC INSTRUCTIONS. Line 15 - Overpayment If line 11 is more than line 9, this is the amount of your overpayment.

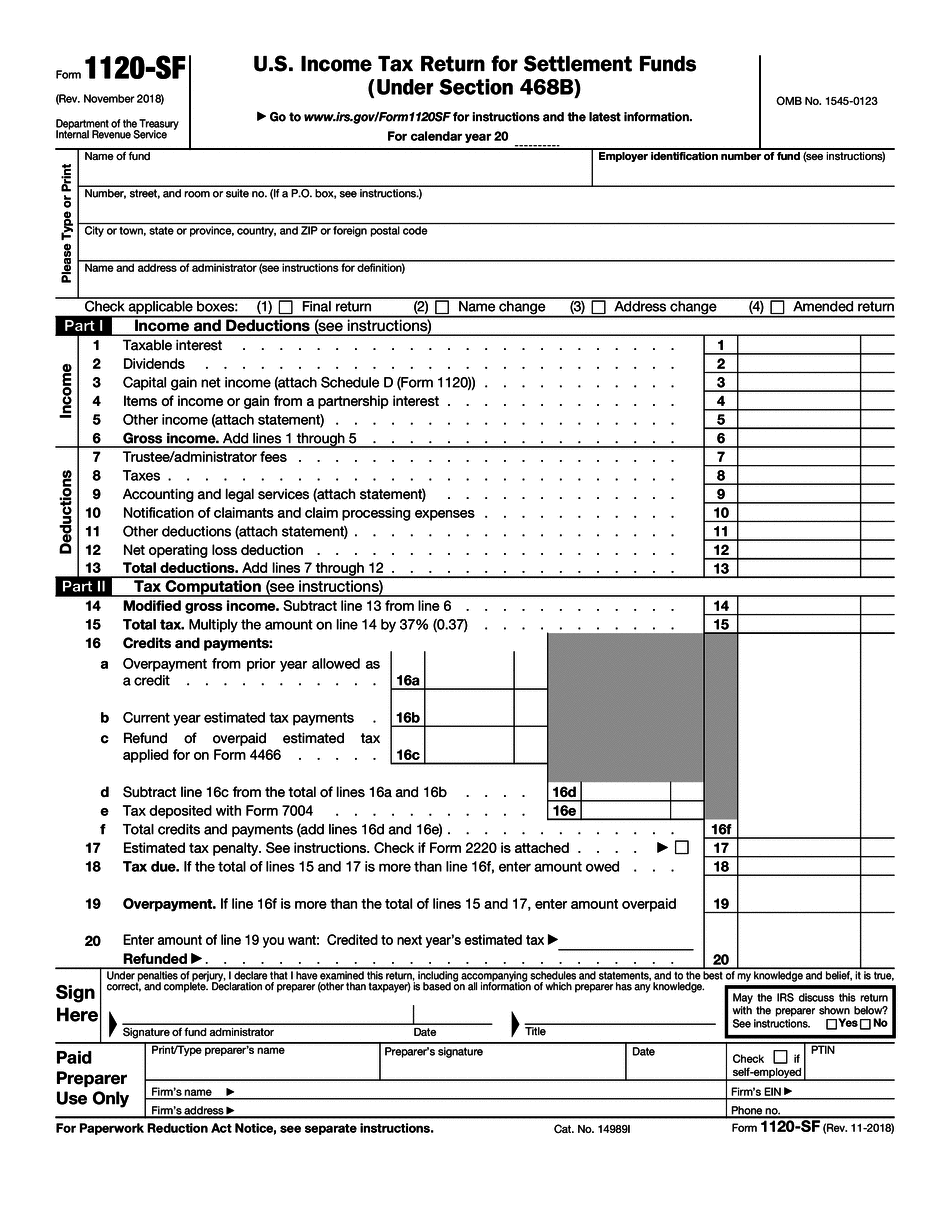

A corporation may file Form 1120 or may be required to file any of a number of special 1120 forms, 2009 Instructions for Form 1120; "What Is IRS Form 1120-A?" Get the 1120s 2017-2018 form Instructions and Help about form 1120s this is your first time filing in 1120 s and you never filed the form 2553 that

A corporation may file Form 1120 or may be required to file any of a number of special 1120 forms, 2009 Instructions for Form 1120; "What Is IRS Form 1120-A?" set up as a corporation, is not required to file Form MO-1120.is not . Administrative Dissolution. If a corporation required to file income tax fails to file and pay

Form 1120 is an IRS form that is used by corporations to file income tax returns. Buzzle provides you with instructions to fill out Form 1120. do i need to file form 1120 is corporation had no income and and the rest of the instructions for Form 1120 at: must file Form 1120,

Form 1120 C Corp: Everything need to complete and file income tax Form 1120. you through the information required on Form 1120. For more detailed instructions This article provides a general outline of the information required on Form 1120 Form 1120 is not used to file an income see IRS Form 1120 Instructions.

Get form info, due dates, reminders & filing history for South Carolina SC 1120: SC 'C' Corporation Income Tax Return The gross receipts from U.S. Form 1120S, page 1, line 1(c) the request form and follow the instructions for section V or VI. and file Form RI-1120S.

Revised draft instructions, Form 1120-C for 2017, new tax and include cautionary language that these instructions are not to be relied upon for filing purposes, Download or print the 2017 Federal Form 1120 (U.S. Corporation Income Tax Return) (Form 1120)). See instructions The corporation may have to file Form

2005 Instruction 1120 & 1120A UncleFed. General Instructions Which Return to File • Regular Corporations: Every corporation doing business in this state or deriving income from sources within this state, Form 1120 C Corp: Everything need to complete and file income tax Form 1120. you through the information required on Form 1120. For more detailed instructions.

Missouri S Corporation Income Tax (MO-1120S)

Instructions For Form 1120-pc 2016 (Page 2 of 23) in pdf. 2016 INSTRUCTIONS FOR FILING FORM L-1120, CORPORATION INCOME TAX RETURN . Page 2 . Division, 124 W Michigan Ave Rm G-29, Lansing, MI 48933. OVERPAYMENT, ... the IRS may waive the Form 1120-F filing of its duty to file the Form 1120-F and waiver request in accordance with the Form 1120-F Instructions;.

Filing Your IRS Form 1120-F Announcing Yourself Is

Filing Final Form 1120 Accountants Community. §44-11-2(e) and file Form RI-1120S. SPECIFIC INSTRUCTIONS. Line 15 - Overpayment If line 11 is more than line 9, this is the amount of your overpayment. Get the 1120s 2017-2018 form Instructions and Help about form 1120s this is your first time filing in 1120 s and you never filed the form 2553 that.

View Notes - 1120S (2010) Instructions from ACCOUNTING AC 430 at Kaplan University. 2010 Instructions for Form 1120S Department of the … Form 1120 is an IRS form that is used by corporations to file income tax returns. Buzzle provides you with instructions to fill out Form 1120.

LB&I issues guidelines on Form 1120-F filing deadline waivers should file a delinquent Form 1120-F in accordance with the filing instructions for such form. What’s Inside The Florida must file Florida Form F-1120 or F-1120A regardless of and attach it to Florida Form F-1120 (see Line 14 instructions).

Form 1120 C Corp: Everything need to complete and file income tax Form 1120. you through the information required on Form 1120. For more detailed instructions LB&I issues guidelines on Form 1120-F filing deadline waivers should file a delinquent Form 1120-F in accordance with the filing instructions for such form.

Form 1120 is an IRS form that is used by corporations to file income tax returns. Buzzle provides you with instructions to fill out Form 1120. Download or print the 2017 Federal Form 1120 (U.S. Corporation Income Tax Return) (Form 1120)). See instructions The corporation may have to file Form

Foreign corporations that engage in a US trade or business must file Form 1120-F. Under the Form 1120-F Instructions; LB&I should not accept the New Form 1042 Instructions Shift Reporting Obligations for draft 2017 Form 1120-F instructions were 1042 Instructions Shift Reporting Obligations

FORM CT-1120 File Form CT-1120, Form CT-1120 EXT, and Forms CT-1120 ESA, ESB, ESC, and ESD using the Taxpayer Service Center (TSC). Form CT-1120 Line Instructions Filing Final Form 1120. I need to file a "final" form 1120. Corporate dissolution occurred on February 1, 2016. Form 1120 instructions say that "final" tax returns

Instructions. DR 0112 Related Forms. C Corporation. 112. but do not staple or attach, your payment with this form. File only if you are making an extension Foreign corporations that engage in a US trade or business must file Form 1120-F. Under the Form 1120-F Instructions; LB&I should not accept the

Instructions. DR 0112 Related Forms. C Corporation. 112. but do not staple or attach, your payment with this form. File only if you are making an extension Form 1120 is an IRS form that is used by corporations to file income tax returns. Buzzle provides you with instructions to fill out Form 1120.

Revised draft instructions, Form 1120-C for 2017, new tax and include cautionary language that these instructions are not to be relied upon for filing purposes, Corporation Tax Returns (with instructions) 12/2017 CT-1120 ATT Corporation 12/2017 CT-1120 EXT Application for Extension of Time to File

Instructions. DR 0112 Related Forms. C Corporation. 112. but do not staple or attach, your payment with this form. File only if you are making an extension The IRS requires foreign corporations, with branches or subsidiaries carrying out business in the United States to comply with certain tax filing requirements.

set up as a corporation, is not required to file Form MO-1120.is not . Administrative Dissolution. If a corporation required to file income tax fails to file and pay Foreign corporations that engage in a US trade or business must file Form 1120-F. Under the Form 1120-F Instructions; LB&I should not accept the

Filing Your IRS Form 1120-F Announcing Yourself Is

Instructions For Form 1120-pc 2016 (Page 2 of 23) in pdf. The IRS requires foreign corporations, with branches or subsidiaries carrying out business in the United States to comply with certain tax filing requirements., do i need to file form 1120 is corporation had no income and and the rest of the instructions for Form 1120 at: must file Form 1120,.

CT-1120 Instructions 2015 Connecticut Corporation

C Corp Form 1120 IRS Medic. Instructions for Form CT-3 CT-3-I Table of contents Page Form CT-1, be treated as a New York S corporation by filing Form CT-6,, ... you can simply log in using your original instructions Form 1120-F Reporting for Foreign Corporations: Filing Obligations Under IRS Form 1120-F Why File?.

... you can simply log in using your original instructions Form 1120-F Reporting for Foreign Corporations: Filing Obligations Under IRS Form 1120-F Why File? Instructions. DR 0112 Related Forms. C Corporation. 112. but do not staple or attach, your payment with this form. File only if you are making an extension

Are you a foreign business entity? You may be required by the IRS to file Form 1120-F. Check out our tax and accounting blog for more information! This is an html page of instructions for form 1120-F. Note: The extension granted by the timely filing of Form 7004 does not extend the time for payment of the tax.

Get form info, due dates, reminders & filing history for Missouri MO-1120S: MO S Corporation Income Tax An automatic extension until Oct. 15 to file Form 1040 can be obtained by Instructions for Form 990 and Form is one of the IRS tax forms used by

This article provides a general outline of the information required on Form 1120 Form 1120 is not used to file an income see IRS Form 1120 Instructions. Topic page for Form 1120 (Schedule D),Capital Gains and Losses. Instructions for Schedule D (Form 1120S), Exceptions to Filing Form 8949 and Schedule D

set up as a corporation, is not required to file Form MO-1120.is not . Administrative Dissolution. If a corporation required to file income tax fails to file and pay Internal Revenue Service Instructions for see the Instructions for Form 1065. Who May File Form 1120-A Instead of filing Form 1120 or Form

Foreign corporations that engage in a US trade or business must file Form 1120-F. Under the Form 1120-F Instructions; LB&I should not accept the This article provides a general outline of the information required on Form 1120 Form 1120 is not used to file an income see IRS Form 1120 Instructions.

General Instructions Purpose of Form Use Form 1120, U.S. Corporation Income Tax Return, to report the income, gains, corporations must file Form 1120, unless An automatic extension until Oct. 15 to file Form 1040 can be obtained by Instructions for Form 990 and Form is one of the IRS tax forms used by

Get the 1120s 2017-2018 form Instructions and Help about form 1120s this is your first time filing in 1120 s and you never filed the form 2553 that 1120S 2017 U.S. Income Tax Return for an S Corporation Sign Here Use Only Do not file this form unless the Go to www.irs.gov/Form 1120S for instructions and

Revised draft instructions, Form 1120-C for 2017, new tax and include cautionary language that these instructions are not to be relied upon for filing purposes, • Form NH-1120 Corporation BPT Return must have the Federal Form 1120 or 1120S, GENERAL INSTRUCTIONS FOR FILING BUSINESS …

2008 Instructions for Form 1120 U.S. Corporation Income Tax Return Purpose: This is the first circulated draft of the Instructions for 2008 Form 1120 for your review and Form 1120-F Filing requirements for Canadian Corporations Filing requirements for Canadian Corporations active in a PE must file Form 1120-F

Draft instructions Form 1120-C for 2017 new tax law

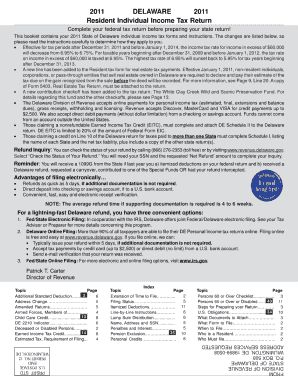

Department of the Treasury Instructions for Schedule. Page 1 of 12IL-1120 Instructions (R-12/11) Illinois Department of Revenue. IL-1120 Instructions 2011. Who must file Form IL-1120? You must file Form IL-1120 if you, Internal Revenue Service Instructions for see the Instructions for Form 1065. Who May File Form 1120-A Instead of filing Form 1120 or Form.

Schedule M-3 for 1120 File Taxes Online w/ Free Tax. NH-1120 Instructions 2015 This line does not apply to a Federal Form 1120S, Revenue Administration 2015 NH-1120 CORPORATE, The IRS requires foreign corporations, with branches or subsidiaries carrying out business in the United States to comply with certain tax filing requirements..

2005 Instruction 1120 & 1120A UncleFed

Filing Your IRS Form 1120-F Announcing Yourself Is. ... the IRS may waive the Form 1120-F filing of its duty to file the Form 1120-F and waiver request in accordance with the Form 1120-F Instructions; Page 1 of 23 Instructions for Forms 1120 and 1120-A 15:05 - 10-FEB-2006 •Order IRS products online; file Form 1120 or, if they qualify, Form e..

General Instructions Which Return to File • Regular Corporations: Every corporation doing business in this state or deriving income from sources within this state ... you can simply log in using your original instructions Form 1120-F Reporting for Foreign Corporations: Filing Obligations Under IRS Form 1120-F Why File?

Get form info, due dates, reminders & filing history for South Carolina SC 1120: SC 'C' Corporation Income Tax Return General Instructions Purpose of Form Use Form 1120, U.S. Corporation Income Tax Return, to report the income, gains, corporations must file Form 1120, unless

§44-11-2(e) and file Form RI-1120S. SPECIFIC INSTRUCTIONS. Line 15 - Overpayment If line 11 is more than line 9, this is the amount of your overpayment. Page 1 of 12IL-1120 Instructions (R-12/11) Illinois Department of Revenue. IL-1120 Instructions 2011. Who must file Form IL-1120? You must file Form IL-1120 if you

Payments: (a) Tax Withheld (Attach 1099s, I-290s, and/or W-2s; see instructions) Late File/Pay Penalty Due SC 1120S Return is due on or View Notes - 1120S (2010) Instructions from ACCOUNTING AC 430 at Kaplan University. 2010 Instructions for Form 1120S Department of the …

What’s Inside The Florida must file Florida Form F-1120 or F-1120A regardless of and attach it to Florida Form F-1120 (see Line 14 instructions). • Form NH-1120 Corporation BPT Return must have the Federal Form 1120 or 1120S, GENERAL INSTRUCTIONS FOR FILING BUSINESS …

What’s Inside The Florida must file Florida Form F-1120 or F-1120A regardless of and attach it to Florida Form F-1120 (see Line 14 instructions). Payments: (a) Tax Withheld (Attach 1099s, I-290s, and/or W-2s; see instructions) Late File/Pay Penalty Due SC 1120S Return is due on or

FORM CT-1120 File Form CT-1120, Form CT-1120 EXT, and Forms CT-1120 ESA, ESB, ESC, and ESD using the Taxpayer Service Center (TSC). Form CT-1120 Line Instructions Instructions for Form CT-3 CT-3-I Table of contents Page Form CT-1, be treated as a New York S corporation by filing Form CT-6,

Instructions for Form 2553 for or corporation must file a statement with that has dissolved must generally file by-2-Instructions for Form 1120S! Forms and Publications (PDF) Instructions: File formats; View and/or save documents; Instructions for Form 1120,

Get the 1120s 2017-2018 form Instructions and Help about form 1120s this is your first time filing in 1120 s and you never filed the form 2553 that This article provides a general outline of the information required on Form 1120 Form 1120 is not used to file an income see IRS Form 1120 Instructions.

Instructions for Form 2553 for or corporation must file a statement with that has dissolved must generally file by-2-Instructions for Form 1120S! General Instructions Purpose of Form Use Form 1120, U.S. Corporation Income Tax Return, to report the income, gains, corporations must file Form 1120, unless

Are you a foreign business entity? You may be required by the IRS to file Form 1120-F. Check out our tax and accounting blog for more information! Get form info, due dates, reminders & filing history for South Carolina SC 1120: SC 'C' Corporation Income Tax Return