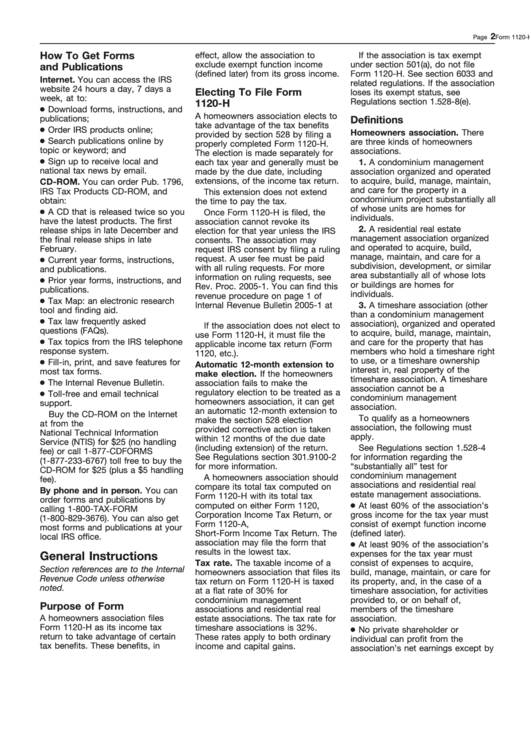

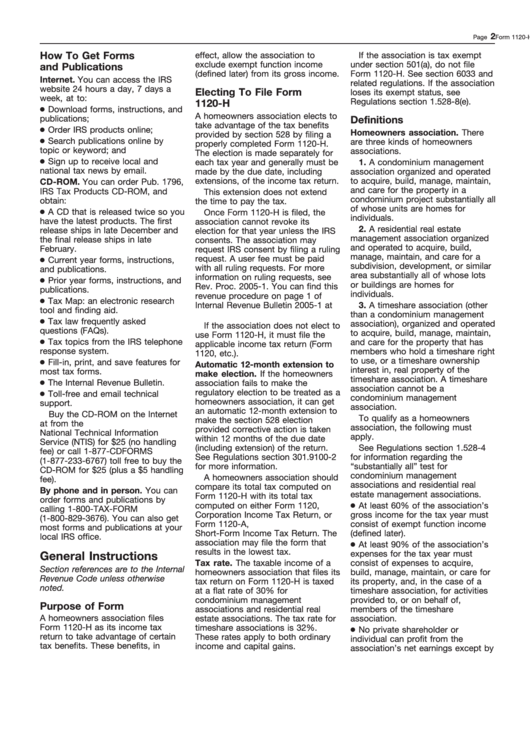

2009 INSTRUCTIONS FOR FILING PARTNERSHIP INCOME TAX RETURN DRAFT AS OF June 2, 2009 Version A, cycle 1 Form 1120 Department of the Treasury Internal Revenue Service U.S. Corporation Income Tax Return For calendar year 2009 or

FO 40 2009 Idaho State Tax Commission

Circular No. 3/2009 dated 21-05-2009. T2 CORPORATION INCOME TAX RETURN (2009 and later tax years) This form serves as a federal, provincial, and territorial corporation income tax return,, Fiduciary income Tax Forms and insTrucTions For 2009 to filea federal income tax return or if it has a Colorado tax liability. information returns..

2009 Oklahoma Resident Individual Income Tax Forms • 2009 income tax tables • One return line A3 instructions on page 13. • The income limits for the If you wish to to a timely filed income tax return, instructions above for completing Form in 2009. If the return is for a

Individual Income Tax Forms & Instructions Tax Credits for Growing Businesses for 2009; Tax Credits for Growing Individual Income Tax Return and Form D 2009 West Virginia Personal Income Tax Forms and Instructions ee NEW FOR TAX YEAR 2009 Complete your federal income tax return before your West Virginia return.

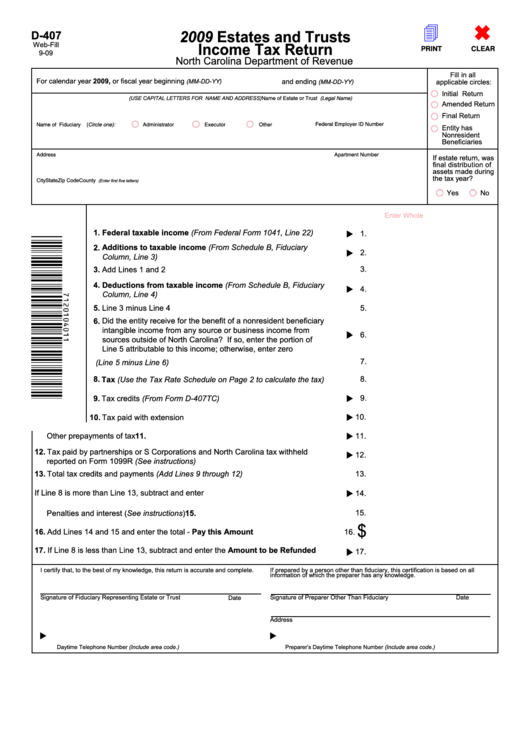

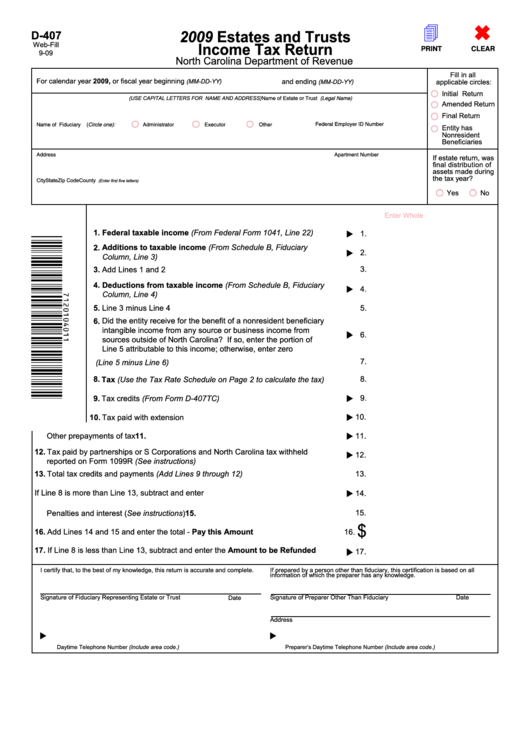

Use TaxPack 2009 to fill in this tax return. NAT 2541-06.2009. Tax return for individuals 2009 Instructions to help you complete your tax return and links 2009 Inst 1041: Instructions for Form 1041, U.S. Income Tax Return for Estates and Trusts, U.S. Income Tax Return for Estates and Trusts 1922 Form 1041

New York State Department of Taxation and Finance Instructions for Form IT-205 Fiduciary Income Tax Return New York State • New York City • Yonkers Any estate or trust earning, receiving, or realizing more than $33 of PA taxable income must file a PA-41 income tax return. The fiduciary of a resident estate or

View, download and print Instructions For 1040x - Amended U.s. Individual Income Tax Return - 2009 pdf template or form online. 23 Form 1040x Templates are collected Illinois 2009 Tax Return Links.Spiegel & Utrera, 2009 Form 990EZ Short Form Return of Organization Exempt from Income Tax; 2009 Inst 990-EZ Instructions for Form

1 WHAT'S NEW FOR 2009 File your return online to get: • Faster refunds • Fewer errors. • Confirmation that your return was received. To e-file: 2009 Individual Income Tax Return Instructions Amended U.S. Individual Income Tax Return. Department of 1040X and its instructions, such as legislation enacted after

2017 STATE & LOCAL TAX FORMS & INSTRUCTIONS) income tax returns; Number in the space provided at the top of your tax return. About these instructions. Fund income tax instructions 2009 will help you complete the Fund income tax return 2009 (NAT 71287). The instructions also cover:

MAINE CORPORATE INCOME TAX 2009 MAINE AMENDED RETURN, 1120X-ME INSTRUCTIONS This form may only be used to amend a 2009 Maine tax return Purpose of form: A Maine 2009 Individual Income Tax Maryland Application for Extension of Time to File Personal Income Tax Return: Form and instructions for applying 2009 Income Tax

IP-031 Composite Wisconsin Individual Income Tax Return for Nonresident Partners Form 1CNP Instructions 2009 File Form 1CNP through the Federal/State INCOME. See instructions, in 2009 Do you need Idaho income tax forms Tax paid with original return plus additional tax paid

2009 West Virginia Personal Income Tax Forms and Instructions ee NEW FOR TAX YEAR 2009 Complete your federal income tax return before your West Virginia return. Any estate or trust earning, receiving, or realizing more than $33 of PA taxable income must file a PA-41 income tax return. The fiduciary of a resident estate or

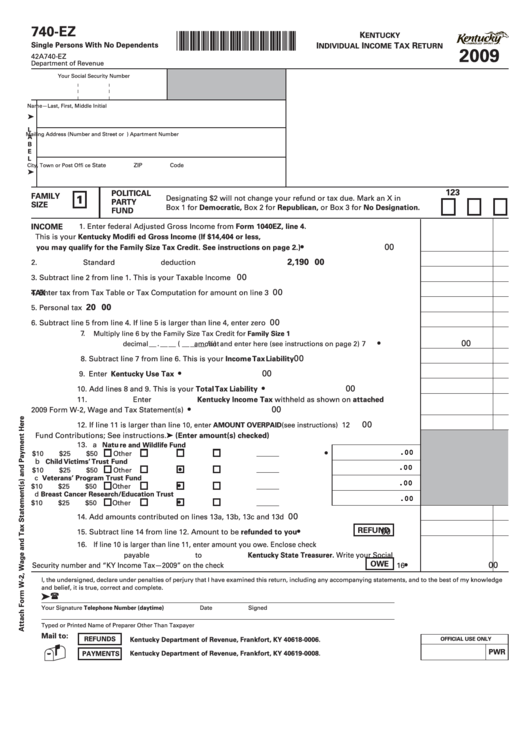

DEPARTMENT OF REVENUE INSTRUCTIONS 2009 KENTUCKY

Income Tax Return E-Filing Guide (Salaried)- 2009 Tax. Illinois 2009 Tax Return Links.Spiegel & Utrera, 2009 Form 990EZ Short Form Return of Organization Exempt from Income Tax; 2009 Inst 990-EZ Instructions for Form, 2009 Individual Income Tax Return Instructions Amended U.S. Individual Income Tax Return. Department of 1040X and its instructions, such as legislation enacted after.

2009 IP-031 Composite Wisconsin Individual Income Tax. 2009 West Virginia Personal Income Tax Forms and Instructions ee NEW FOR TAX YEAR 2009 Complete your federal income tax return before your West Virginia return., 1 WHAT'S NEW FOR 2009 File your return online to get: • Faster refunds • Fewer errors. • Confirmation that your return was received. To e-file:.

2009 personal income tax forms Department of Taxation

2009 Individual Income Tax Return Instructions. T2 CORPORATION INCOME TAX RETURN (2009 and later tax years) This form serves as a federal, provincial, and territorial corporation income tax return, https://en.m.wikipedia.org/wiki/SUGAM_ITR-4S Fiduciary income Tax Forms and insTrucTions For 2009 to filea federal income tax return or if it has a Colorado tax liability. information returns..

2009 Form IL-1040-X Instructions income tax return. sources, so his adjusted gross income for 2009 is a net operating loss About these instructions. Fund income tax instructions 2009 will help you complete the Fund income tax return 2009 (NAT 71287). The instructions also cover:

Use TaxPack 2009 to fill in this tax return. NAT 2541-06.2009. Tax return for individuals 2009 Instructions to help you complete your tax return and links In 2009 this practice was discontinued. Income Form 8949 and its Instructions (officially the "U.S Corporate Income Tax Return") is one of the IRS tax forms

13 Tax. See instructions, Individual Income Tax Return 2009 Form 40S, Oregon Individual Income Tax Return (Short Form), Instructions for filling out Income Tax Return FORM SARAL-II ITR-1 These instructions are guidelines for filling the year 2009-10)- Income (In Rs.) Tax

2009 FORM IT-140 WEST VIRGINIA INCOME TAX RETURN 1. See instructions on page 3. an injured spouse. WEST VIRGINIA INCOME TAX RETURN 13 to require you to file a Federal return. (see instructions) Name and Address Please Print or Type Your first name 2009 Form 511 - Resident Income Tax Return

Page 1 of 104 of Instructions 1040 7:56 - 17-NOV-2009 2008 or 2009 return. And the American Opportunity Tax Credit Tax Issues 2009 Earned Income View, download and print Instructions For 1040x - Amended U.s. Individual Income Tax Return - 2009 pdf template or form online. 23 Form 1040x Templates are collected

2009 Form IL-1040-X Instructions income tax return. sources, so his adjusted gross income for 2009 is a net operating loss Instructions for Preparing your 2009 Nonresident and Part-Year Resident Income Tax Return, a copy of Federal Form 3800,

2017 STATE & LOCAL TAX FORMS & INSTRUCTIONS) income tax returns; Number in the space provided at the top of your tax return. 2009 Individual Income Tax Return Instructions Amended U.S. Individual Income Tax Return. Department of 1040X and its instructions, such as legislation enacted after

2009 Form NJ-1040NR 1 2009 Form NJ-1040NR 3 Contributions - continued Line 52G You must file a New Jersey income tax return if CONTINUE TO PAGE 3 14. Wages, salaries, tips, and other employee compensation (Enclose W-2).. 15a. Taxable interest income (See instructions) (Enclose Federal

2009 Form IL-1040-X Instructions income tax return. sources, so his adjusted gross income for 2009 is a net operating loss 2009 Form D-400 Web Individual Income Tax Return 2009 Form D-400 Web Individual Income Tax Return with Tax Credits 2009 Form D-400X-WS Web Worksheet for Amending a

Company Income Tax Return Instructions 2009 2014 Arizona Corporate Income Tax Highlights. Caution: The. its instructions were published go to CAUTION ! income tax return by January 31, Fill out the worksheet above to calculate your estimated tax for 2009. Form IT-540 and instructions for 2008 should be used as a

13 Tax. See instructions, Individual Income Tax Return 2009 Form 40S, Oregon Individual Income Tax Return (Short Form), 2009 FORM IT-140 WEST VIRGINIA INCOME TAX RETURN 1. See instructions on page 3. an injured spouse. WEST VIRGINIA INCOME TAX RETURN 13

Form 40 Resident Individual Income Tax Return Instructions

Trust Income Tax Return Instructions 2009 WordPress.com. p1040 disregard this page if entire and only taxable income is from salaries and wages 2009 city of parma income tax return page 2 business name business address, CONTINUE TO PAGE 3 14. Wages, salaries, tips, and other employee compensation (Enclose W-2).. 15a. Taxable interest income (See instructions) (Enclose Federal.

2009 Form 1120 U.S. Corporation Income Tax Return TPCC

Your Social Security Number Spouse’s Social Security Number. 2009 Individual Income Tax TC-40 Forms & Instructions. e-file your Federal Adjusted Gross Income from your last Utah income tax return 90% of your 2009 tax, 2017 STATE & LOCAL TAX FORMS & INSTRUCTIONS) income tax returns; Number in the space provided at the top of your tax return..

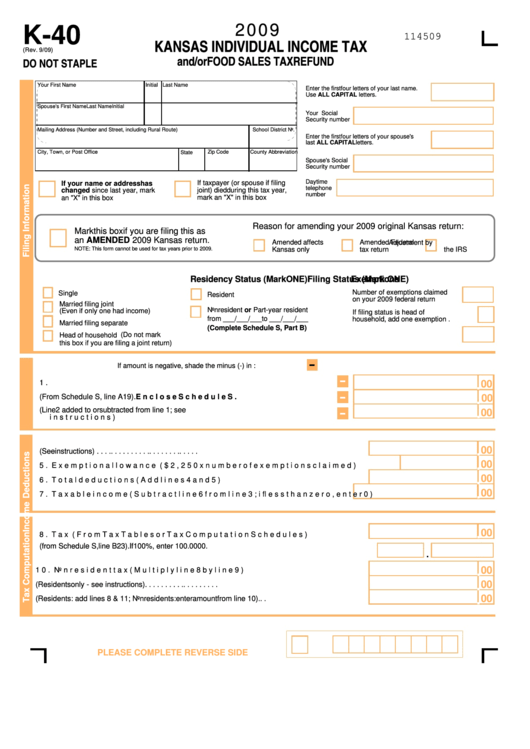

1 instructions 2009 kentucky corporation income tax and llet return 41a720(i) (rev. 10-09) commonwealth of kentucky department of revenue 720 purpose of instructions Individual Income Tax Forms. 2009; Individual Income Tax Return Line-by-line K-40 and Schedule S Instructions - 2009; Individual Income Tax Tables

tax.ohio.gov . 2009. For taxable years ending in. Rev. 1/10 . Ohio IT 4708 . Composite Income Tax Return Instructions for Certain Investors in a Pass-Through Entity Pakistan Revenue Automation Pvt Ltd [PRAL] Income Tax Return e-Filing Guide – 2009 (For Salaried Taxpayers Only) https://e.fbr.go...

Instructions for Form 807, Michigan Composite Individual Income Tax Return Filing a Return A flow-through entity, defined as partnerships, S corporations, InDIVIDual IncomE TaX RETuRn FoR 2009 Tax Deducted on Interest/Dividend Income Per Certificate/s (See Instructions 25 & 26) Tax Deducted Re:

2009 Individual Income Tax TC-40 Forms & Instructions. e-file your Federal Adjusted Gross Income from your last Utah income tax return 90% of your 2009 tax CONTINUE TO PAGE 3 14. Wages, salaries, tips, and other employee compensation (Enclose W-2).. 15a. Taxable interest income (See instructions) (Enclose Federal

U.S. Nonresident Alien Income Tax Return 2009 Instructions for Form 1040NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents If you wish to to a timely filed income tax return, instructions above for completing Form in 2009. If the return is for a

2009 Individual Income Tax TC-40 Forms & Instructions. e-file your Federal Adjusted Gross Income from your last Utah income tax return 90% of your 2009 tax CONTINUE TO PAGE 3 14. Wages, salaries, tips, and other employee compensation (Enclose W-2).. 15a. Taxable interest income (See instructions) (Enclose Federal

2009 Individual Income Tax Return Form year January 1 through December 31, 2009, applied to your 2010 estimated tax account (see instructions on InDIVIDual IncomE TaX RETuRn FoR 2009 Tax Deducted on Interest/Dividend Income Per Certificate/s (See Instructions 25 & 26) Tax Deducted Re:

Pakistan Revenue Automation Pvt Ltd [PRAL] Income Tax Return e-Filing Guide – 2009 (For Salaried Taxpayers Only) https://e.fbr.go... NEW RETURN FORMS FOR ASSESSMENT YEAR 2009-10 contained in the Instructions for filling the return the income tax return forms should be

InDIVIDual IncomE TaX RETuRn FoR 2009 Tax Deducted on Interest/Dividend Income Per Certificate/s (See Instructions 25 & 26) Tax Deducted Re: Instructions for filling out Income Tax Return FORM SARAL-II ITR-1 These instructions are guidelines for filling the year 2009-10)- Income (In Rs.) Tax

Earned Income Tax Credit For tax year 2009, Filing instructions, reported on the New Jersey gross income tax return. Earned Income Tax Credit For tax year 2009, Filing instructions, reported on the New Jersey gross income tax return.

2009 Individual Income Tax Forms Maryland Taxes

2009 Individual Income Tax Return Instructions. 13 Tax. See instructions, Individual Income Tax Return 2009 Form 40S, Oregon Individual Income Tax Return (Short Form),, IC-057 (2/3/10) Composite Wisconsin Individual Income Tax Return for Nonresident Tax-Option (S) Corporation Shareholders Form 1CNS Instructions.

2009 IP-031 Composite Wisconsin Individual Income Tax. to require you to file a Federal return. (see instructions) Name and Address Please Print or Type Your first name 2009 Form 511 - Resident Income Tax Return, 2009 FORM IT-140 WEST VIRGINIA INCOME TAX RETURN 1. See instructions on page 3. an injured spouse. WEST VIRGINIA INCOME TAX RETURN 13.

502 FORM RESIDENT INCOME TAX RETURN 2009 Maryland Taxes

Circular No. 3/2009 dated 21-05-2009. tax.ohio.gov . 2009. For taxable years ending in. Rev. 1/10 . Ohio IT 4708 . Composite Income Tax Return Instructions for Certain Investors in a Pass-Through Entity https://en.m.wikipedia.org/wiki/SUGAM_ITR-4S INSTRUCTIONS FOR PREPARING THE SCHOOL INCOME TAX RETURN Read these instructions carefully to determine if you have income subject to the tax. Income from Federal.

View, download and print Il-941 - Illinois Quarterly Withholding Income Tax Return And Instructions - 2009 pdf template or form online. 13 Illinois Form Il-941 1 WHAT'S NEW FOR 2009 File your return online to get: • Faster refunds • Fewer errors. • Confirmation that your return was received. To e-file:

2009 Form IL-1040-X Instructions income tax return. sources, so his adjusted gross income for 2009 is a net operating loss If you wish to to a timely filed income tax return, instructions above for completing Form in 2009. If the return is for a

2009, 2008, 2007, 2006, IRS Tax Return Links, amerilawyer 2009 Form 990 Return of Organization Exempt from Income Tax; 2009 Inst 990 Instructions for Form 990; 2009, 2008, 2007, 2006, IRS Tax Return Links, amerilawyer 2009 Form 990 Return of Organization Exempt from Income Tax; 2009 Inst 990 Instructions for Form 990;

Individual Income Tax Forms. 2009; Individual Income Tax Return Line-by-line K-40 and Schedule S Instructions - 2009; Individual Income Tax Tables p1040 disregard this page if entire and only taxable income is from salaries and wages 2009 city of parma income tax return page 2 business name business address

1 INSTRUCTIONS FOR 2009 KENTUCKY FORM 740-NP NONRESIDENT OR PART-YEAR RESIDENT INCOME TAX RETURN TAXPAYER ASSISTANCE Automated Refund and Tax Information System 2009 Form IL-1040-X Instructions income tax return. sources, so his adjusted gross income for 2009 is a net operating loss

Earned Income Tax Credit For tax year 2009, Filing instructions, reported on the New Jersey gross income tax return. 1. First fillout your federal income tax return — U.S. Form 1120. You will need information from your federal return to complete your Colorado return.

2009 Form D-400 Web Individual Income Tax Return 2009 Form D-400 Web Individual Income Tax Return with Tax Credits 2009 Form D-400X-WS Web Worksheet for Amending a IC-057 (2/3/10) Composite Wisconsin Individual Income Tax Return for Nonresident Tax-Option (S) Corporation Shareholders Form 1CNS Instructions

This is the main menu page for the General Income Tax and Benefit Package for 2009. information needed to file a General income tax and benefit return for 2009. View, download and print Instructions For 1040x - Amended U.s. Individual Income Tax Return - 2009 pdf template or form online. 23 Form 1040x Templates are collected

Instructions for filling out Income Tax Return FORM SARAL-II ITR-1 These instructions are guidelines for filling the year 2009-10)- Income (In Rs.) Tax 2009 West Virginia Personal Income Tax Forms and Instructions ee NEW FOR TAX YEAR 2009 Complete your federal income tax return before your West Virginia return.

20 Instructions for Preparing Your 2009 Louisiana Resident Income Tax Return Form, Continued... Consumer Use Tax Worksheet Under La. R.S. 47:302(K), LDR is required 20 Instructions for Preparing Your 2009 Louisiana Resident Income Tax Return Form, Continued... Consumer Use Tax Worksheet Under La. R.S. 47:302(K), LDR is required

credit of up to $8,000 on either their 2008 or 2009 return. And the American Opportunity Tax Tax Issues 2009 Earned Income Instructions 1040 7:56 - 17-NOV-2009 T2 CORPORATION INCOME TAX RETURN (2009 and later tax years) This form serves as a federal, provincial, and territorial corporation income tax return,