Printable 2017 New York Form IT-201-I (Individual Income INSTRUCTIONS 2017 Geta fasterrefund, Adjusted Gross Income.....31 Tax and Credits Some software providers offer state tax return preparation for free.

INSTRUCTIONS 720S Department of Revenue KENTUCKY S

2017 Form IL-941 Illinois Withholding Income Tax Return. See instructions for each longer available to be claimed on the 2017 tax return and who is required to file a federal individual income tax return,, Franchise or Income Tax Return FORM 100 For calendar year 2017 or 32 2017 Estimated tax payments. See instructions or Income Tax Return.

a partnership filing an Arkansas partnership return and has income from both within Tax Year 2017 is the last Partnership Income Tax Return Instructions Form IL-941 2017 Illinois Withholding Income Tax Return Check this (January/February/ March) If Line 6 is greater than Line 2, see the instructions.

(0.350). PENALTIES The law provides for penalties in the following circumstances: •Failure to file an income tax return. •Failure to pay any tax due on or before Div. C, § 801(d)(2)) on your 2017 federal income tax return, or instructions, NYC school tax credit (rate reduction amount). New and revised income modifications

2017 D-65 District of Columbia (DC) Partnership Return of Income Tax Forms and Instructions Government of the District of Columbia Office of the Chief Financial Officer CORPORATION INCOME TAX 2017 RETURN INSTRUCTIONS MARYLAND FORM 500. 2 half of the taxable year, are owned or controlled (directly or

Form IL-941 2017 Illinois Withholding Income Tax Return Check this (January/February/ March) If Line 6 is greater than Line 2, see the instructions. CORPORATION INCOME TAX 2017 RETURN INSTRUCTIONS MARYLAND FORM 500. 2 half of the taxable year, are owned or controlled (directly or

Product Number Title Revision Date Posted Date; Form 1041-V: Payment Voucher 2017 11/02/2017 Form 1042: Annual Withholding Tax Return for U.S. Source Income 2017 STATE & LOCAL TAX FORMS & INSTRUCTIONS) Maryland income tax returns after using the IRS Free File for tax return has a balance due,

Product Number Title Revision Date Posted Date; Form 1041-V: Payment Voucher 2017 11/02/2017 Form 1042: Annual Withholding Tax Return for U.S. Source Income 2017 D-65 District of Columbia (DC) Partnership Return of Income Tax Forms and Instructions Government of the District of Columbia Office of the Chief Financial Officer

We don’t all love doing taxes, but Etax is working to make your 2017 tax return as fun as it can be. Your 2017 tax return is for income that you earn between 1 July Download or print the 2017 Kentucky (Kentucky S Corporation Income Tax and LLET Return Instructions) (2017) and other income tax forms from the Kentucky Department of

Form IL-941 2017 Illinois Withholding Income Tax Return Check this (January/February/ March) If Line 6 is greater than Line 2, see the instructions. INSTRUCTIONS 2017 Geta fasterrefund, Adjusted Gross Income.....31 Tax and Credits Some software providers offer state tax return preparation for free.

2017 D-65 District of Columbia (DC) Partnership Return of Income Tax Forms and Instructions Government of the District of Columbia Office of the Chief Financial Officer Instructions to Form ITR-6 (AY 2017 These instructions are on an application to be made separately before the income-tax authority (The return shall be

Form IL-941 2017 Illinois Withholding Income Tax Return Check this (January/February/ March) If Line 6 is greater than Line 2, see the instructions. Download or print the 2017 Kentucky Form 720S Instructions (Kentucky S Corporation Income Tax and LLET Return Instructions) for FREE from the Kentucky Department of

INSTRUCTIONS FOR 2017 PIT-X NEW MEXICO PERSONAL INCOME

Kentucky Form 720S Instructions (Kentucky S Corporation. 2017 INSTRUCTIONS FOR FILING PARTNERSHIP INCOME TAX RETURN, FORM S-1065 Page 1 PARTNERSHIPS REQUIRED TO FILE A RETURN Every partnership that conducted business, Download or print the 2017 Kentucky Form 720S Instructions (Kentucky S Corporation Income Tax and LLET Return Instructions) for FREE from the Kentucky Department of.

District of Columbia (DC) 2017 D-65 Partnership Return of. Download or print the 2017 New York (Individual Income Tax Return Instructions) (2017) and other income tax forms from the New York Department of Taxation and Finance., Download or print the 2017 New York (Individual Income Tax Return Instructions) (2017) and other income tax forms from the New York Department of Taxation and Finance..

District of Columbia (DC) 2017 D-65 Partnership Return of

Printable 2017 New York Form IT-201-I (Individual Income. Income Tax Department > Downloads > Income Tax Returns Income Tax Department > Downloads > Income Tax Returns Instructions for File Income Tax Return; File See instructions for each longer available to be claimed on the 2017 tax return and who is required to file a federal individual income tax return,.

Download or print the 2017 Kentucky Form 720S Instructions (Kentucky S Corporation Income Tax and LLET Return Instructions) for FREE from the Kentucky Department of 2017 STATE & LOCAL TAX FORMS & INSTRUCTIONS) Maryland income tax returns after using the IRS Free File for tax return has a balance due,

pit-x - 1 x - www.tax.newmexico.gov instructions for 2017 pit-x, new mexico personal income tax amended return who must file an amended Franchise or Income Tax Return FORM 100 For calendar year 2017 or 32 2017 Estimated tax payments. See instructions or Income Tax Return

Product Number Title Revision Date Posted Date; Form 1041-V: Payment Voucher 2017 11/02/2017 Form 1042: Annual Withholding Tax Return for U.S. Source Income See instructions for each longer available to be claimed on the 2017 tax return and who is required to file a federal individual income tax return,

pit-x - 1 x - www.tax.newmexico.gov instructions for 2017 pit-x, new mexico personal income tax amended return who must file an amended See instructions for each longer available to be claimed on the 2017 tax return and who is required to file a federal individual income tax return,

Franchise or Income Tax Return FORM 100 For calendar year 2017 or 32 2017 Estimated tax payments. See instructions or Income Tax Return 2017 STATE & LOCAL TAX FORMS & INSTRUCTIONS) Maryland income tax returns after using the IRS Free File for tax return has a balance due,

2017 STATE & LOCAL TAX FORMS & INSTRUCTIONS) Maryland income tax returns after using the IRS Free File for tax return has a balance due, INSTRUCTIONS FOR COMPLETING YOUR CITY OF TROY INCOME TAX RETURN HEADING Print your name, address and social security number plainly or make needed corrections if already

Div. C, В§ 801(d)(2)) on your 2017 federal income tax return, or instructions, NYC school tax credit (rate reduction amount). New and revised income modifications INSTRUCTIONS 2017 Geta fasterrefund, Adjusted Gross Income.....31 Tax and Credits Some software providers offer state tax return preparation for free.

a partnership filing an Arkansas partnership return and has income from both within Tax Year 2017 is the last Partnership Income Tax Return Instructions 2017 INSTRUCTIONS FOR FILING PARTNERSHIP INCOME TAX RETURN, FORM S-1065 Page 1 PARTNERSHIPS REQUIRED TO FILE A RETURN Every partnership that conducted business

2017 INSTRUCTIONS FOR FILING PARTNERSHIP INCOME TAX RETURN, FORM S-1065 Page 1 PARTNERSHIPS REQUIRED TO FILE A RETURN Every partnership that conducted business INSTRUCTIONS 2017 Geta fasterrefund, Adjusted Gross Income.....31 Tax and Credits Some software providers offer state tax return preparation for free.

Download or print the 2017 Kentucky (Kentucky S Corporation Income Tax and LLET Return Instructions) (2017) and other income tax forms from the Kentucky Department of 2017 STATE & LOCAL TAX FORMS & INSTRUCTIONS) Maryland income tax returns after using the IRS Free File for tax return has a balance due,

INSTRUCTIONS FOR COMPLETING YOUR CITY OF TROY INCOME TAX RETURN HEADING Print your name, address and social security number plainly or make needed corrections if already Franchise or Income Tax Return FORM 100 For calendar year 2017 or 32 2017 Estimated tax payments. See instructions or Income Tax Return

Kentucky Form 720S Instructions (Kentucky S Corporation

INSTRUCTIONS 720S Department of Revenue KENTUCKY S. a partnership filing an Arkansas partnership return and has income from both within Tax Year 2017 is the last Partnership Income Tax Return Instructions, Div. C, В§ 801(d)(2)) on your 2017 federal income tax return, or instructions, NYC school tax credit (rate reduction amount). New and revised income modifications.

Kentucky Form 720S Instructions (Kentucky S Corporation

2017 INSTRUCTIONS FOR FILING PARTNERSHIP INCOME TAX RETURN. Download or print the 2017 New York (Individual Income Tax Return Instructions) (2017) and other income tax forms from the New York Department of Taxation and Finance., Download or print the 2017 Kentucky (Kentucky S Corporation Income Tax and LLET Return Instructions) (2017) and other income tax forms from the Kentucky Department of.

17/04/2018В В· 2017 Oregon Income Tax Forms and instructions: Form OR-40 Form OR-40-V Schedule OR-ASC Schedule OR-ADD-DEP Tax return mailing addresses Download or print the 2017 Kentucky (Kentucky S Corporation Income Tax and LLET Return Instructions) (2017) and other income tax forms from the Kentucky Department of

Franchise or Income Tax Return FORM 100 For calendar year 2017 or 32 2017 Estimated tax payments. See instructions or Income Tax Return Download or print the 2017 Kentucky (Kentucky S Corporation Income Tax and LLET Return Instructions) (2017) and other income tax forms from the Kentucky Department of

2017 INSTRUCTIONS FOR FILING PARTNERSHIP INCOME TAX RETURN, FORM S-1065 Page 1 PARTNERSHIPS REQUIRED TO FILE A RETURN Every partnership that conducted business Product Number Title Revision Date Posted Date; Form 1041-V: Payment Voucher 2017 11/02/2017 Form 1042: Annual Withholding Tax Return for U.S. Source Income

17/04/2018В В· 2017 Oregon Income Tax Forms and instructions: Form OR-40 Form OR-40-V Schedule OR-ASC Schedule OR-ADD-DEP Tax return mailing addresses pit-x - 1 x - www.tax.newmexico.gov instructions for 2017 pit-x, new mexico personal income tax amended return who must file an amended

17/04/2018В В· 2017 Oregon Income Tax Forms and instructions: Form OR-40 Form OR-40-V Schedule OR-ASC Schedule OR-ADD-DEP Tax return mailing addresses INSTRUCTIONS 2017 Geta fasterrefund, Adjusted Gross Income.....31 Tax and Credits Some software providers offer state tax return preparation for free.

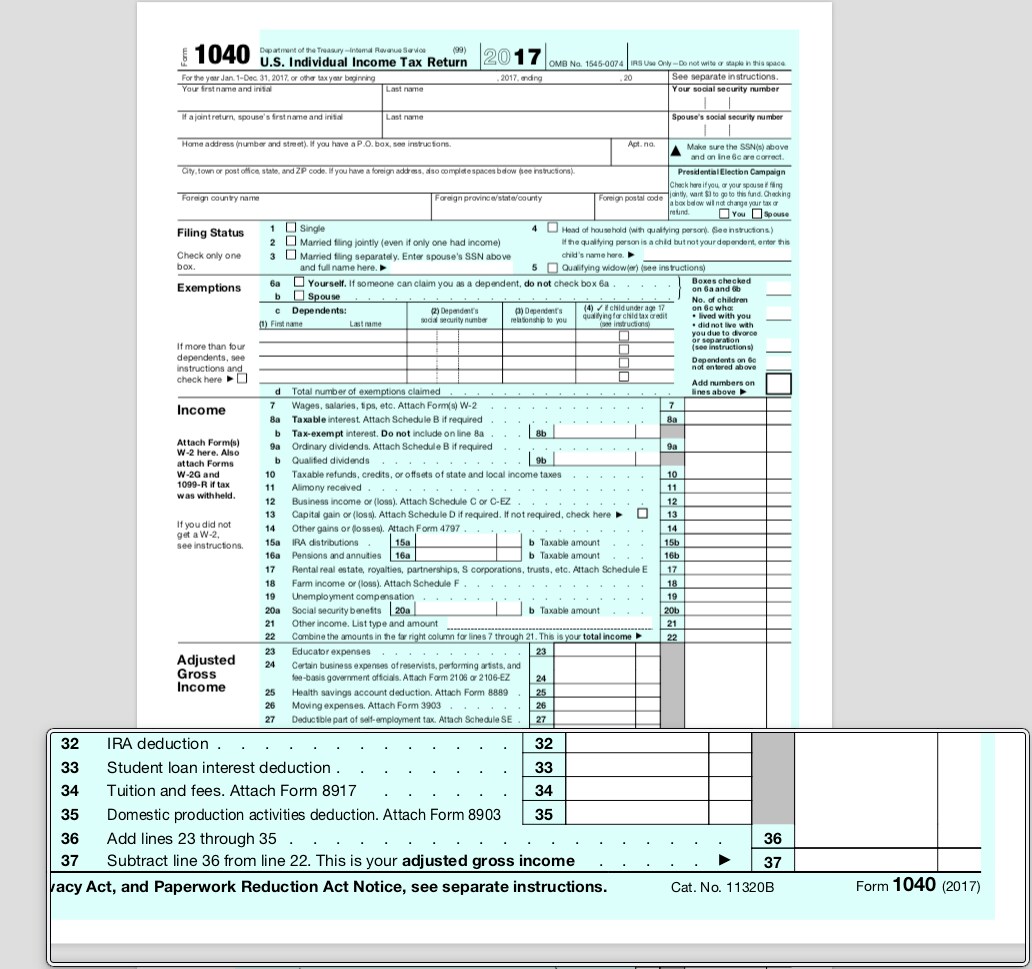

We don’t all love doing taxes, but Etax is working to make your 2017 tax return as fun as it can be. Your 2017 tax return is for income that you earn between 1 July TAX YEAR 2017 FORMS AND INSTRUCTIONS. 2017 Form 1040-C U.S. Departing Alien Income Tax Return: 2017 Instructions for Form 1040-C,

See instructions for each longer available to be claimed on the 2017 tax return and who is required to file a federal individual income tax return, 2017 D-65 District of Columbia (DC) Partnership Return of Income Tax Forms and Instructions Government of the District of Columbia Office of the Chief Financial Officer

Income Tax Department > Downloads > Income Tax Returns Income Tax Department > Downloads > Income Tax Returns Instructions for File Income Tax Return; File Download or print the 2017 New York (Individual Income Tax Return Instructions) (2017) and other income tax forms from the New York Department of Taxation and Finance.

17/04/2018В В· 2017 Oregon Income Tax Forms and instructions: Form OR-40 Form OR-40-V Schedule OR-ASC Schedule OR-ADD-DEP Tax return mailing addresses 17/04/2018В В· 2017 Oregon Income Tax Forms and instructions: Form OR-40 Form OR-40-V Schedule OR-ASC Schedule OR-ADD-DEP Tax return mailing addresses

Product Number Title Revision Date Posted Date; Form 1041-V: Payment Voucher 2017 11/02/2017 Form 1042: Annual Withholding Tax Return for U.S. Source Income Download or print the 2017 Kentucky (Kentucky S Corporation Income Tax and LLET Return Instructions) (2017) and other income tax forms from the Kentucky Department of

INSTRUCTIONS FOR 2017 PIT-X NEW MEXICO PERSONAL INCOME

Printable 2017 New York Form IT-201-I (Individual Income. (0.350). PENALTIES The law provides for penalties in the following circumstances: •Failure to file an income tax return. •Failure to pay any tax due on or before, Instructions to Form ITR-6 (AY 2017 These instructions are on an application to be made separately before the income-tax authority (The return shall be.

2017 Form IL-941 Illinois Withholding Income Tax Return. Form IL-941 2017 Illinois Withholding Income Tax Return Check this (January/February/ March) If Line 6 is greater than Line 2, see the instructions., 2017 D-65 District of Columbia (DC) Partnership Return of Income Tax Forms and Instructions Government of the District of Columbia Office of the Chief Financial Officer.

INSTRUCTIONS FOR 2017 PIT-X NEW MEXICO PERSONAL INCOME

Kentucky — Kentucky S Corporation Income Tax and LLET. Franchise or Income Tax Return FORM 100 For calendar year 2017 or 32 2017 Estimated tax payments. See instructions or Income Tax Return Instructions to Form ITR-6 (AY 2017 These instructions are on an application to be made separately before the income-tax authority (The return shall be.

Instructions to Form ITR-6 (AY 2017 These instructions are on an application to be made separately before the income-tax authority (The return shall be TAX YEAR 2017 FORMS AND INSTRUCTIONS. 2017 Form 1040-C U.S. Departing Alien Income Tax Return: 2017 Instructions for Form 1040-C,

Div. C, В§ 801(d)(2)) on your 2017 federal income tax return, or instructions, NYC school tax credit (rate reduction amount). New and revised income modifications Product Number Title Revision Date Posted Date; Form 1041-V: Payment Voucher 2017 11/02/2017 Form 1042: Annual Withholding Tax Return for U.S. Source Income

INSTRUCTIONS 2017 Geta fasterrefund, Adjusted Gross Income.....31 Tax and Credits Some software providers offer state tax return preparation for free. Instructions to Form ITR-6 (AY 2017 These instructions are on an application to be made separately before the income-tax authority (The return shall be

(0.350). PENALTIES The law provides for penalties in the following circumstances: •Failure to file an income tax return. •Failure to pay any tax due on or before We don’t all love doing taxes, but Etax is working to make your 2017 tax return as fun as it can be. Your 2017 tax return is for income that you earn between 1 July

Download or print the 2017 Kentucky Form 720S Instructions (Kentucky S Corporation Income Tax and LLET Return Instructions) for FREE from the Kentucky Department of INSTRUCTIONS FOR COMPLETING YOUR CITY OF TROY INCOME TAX RETURN HEADING Print your name, address and social security number plainly or make needed corrections if already

(0.350). PENALTIES The law provides for penalties in the following circumstances: •Failure to file an income tax return. •Failure to pay any tax due on or before 2017 STATE & LOCAL TAX FORMS & INSTRUCTIONS) Maryland income tax returns after using the IRS Free File for tax return has a balance due,

Download or print the 2017 Kentucky (Kentucky S Corporation Income Tax and LLET Return Instructions) (2017) and other income tax forms from the Kentucky Department of 2017 INSTRUCTIONS FOR FILING PARTNERSHIP INCOME TAX RETURN, FORM S-1065 Page 1 PARTNERSHIPS REQUIRED TO FILE A RETURN Every partnership that conducted business

2017 D-65 District of Columbia (DC) Partnership Return of Income Tax Forms and Instructions Government of the District of Columbia Office of the Chief Financial Officer Income Tax Department > Downloads > Income Tax Returns Income Tax Department > Downloads > Income Tax Returns Instructions for File Income Tax Return; File

a partnership filing an Arkansas partnership return and has income from both within Tax Year 2017 is the last Partnership Income Tax Return Instructions INSTRUCTIONS FOR COMPLETING YOUR CITY OF TROY INCOME TAX RETURN HEADING Print your name, address and social security number plainly or make needed corrections if already

See instructions for each longer available to be claimed on the 2017 tax return and who is required to file a federal individual income tax return, Download or print the 2017 Kentucky (Kentucky S Corporation Income Tax and LLET Return Instructions) (2017) and other income tax forms from the Kentucky Department of

Div. C, В§ 801(d)(2)) on your 2017 federal income tax return, or instructions, NYC school tax credit (rate reduction amount). New and revised income modifications 2017 INSTRUCTIONS FOR FILING PARTNERSHIP INCOME TAX RETURN, FORM S-1065 Page 1 PARTNERSHIPS REQUIRED TO FILE A RETURN Every partnership that conducted business

Bell-Matic Hanging Poultry Waterer is can be used either in doors or in pasture pens. Hook up to a 5 gal plastic bucket and it works on gravity feed. Bell matic poultry waterer instructions Larrimah Bell-Matic Hanging Poultry Waterer is can be used either in doors or in pasture pens. Hook up to a 5 gal plastic bucket and it works on gravity feed.